Leave Your Legacy with a Planned Gift

Since 1977, SafeHouse Denver has invested in the future of the Denver metro area by providing programs and services that help survivors of domestic violence pursue safe, abuse-free lives.

We invite you to join us in continuing to build this safe future by becoming a member of our Legacy of Hope Society. Created in 2014, the Legacy of Hope Society recognizes the extraordinary commitment of people who include SafeHouse Denver in their estate plans. Through planned gifts, our programs will consistently grow, ensuring that the organization will remain financially strong and your values as a donor will be sustained.

Ways To Give

There are several ways you can make planned gifts to SafeHouse Denver and enjoy tax and income benefits:

- Bequest (Will or Living Trust)

- Beneficiary Designation (Life Insurance or IRA)

- Charitable Gift Annuity

- Charitable Remainder Trust

- Charitable Lead Trust

- Retained Life Estate

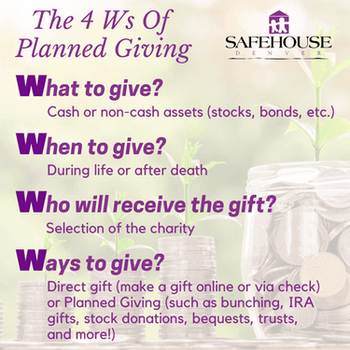

Planned giving is a way to integrate your personal, financial and estate planning by making charitable gifts that benefit you, your family and the nonprofit organization of your choice. When you make a planned gift to SafeHouse Denver, you make a lasting investment in the safety and support of survivors of domestic violence.

Perhaps most importantly, planned gifts are an extension of what you value as an individual and leave a legacy around that purpose, kindness and motivation for change.

Every situation is unique. Please contact your financial advisor to design a plan that is uniquely tailored to meet your philanthropic objectives.

9 Tips To Write A Will

If you Google "how to write a will," you'll come up with 11,260,000,000 results. The truth, though, is that there is no one-size-fits-all approach. The following tips are shared from various resources, but are not meant to be exhaustive. As always, please consult a professional for your unique situation.

1. Decide if you’ll use an Estate Planning Attorney, a DIY kit or an online program.

2. Choose your executor – the person responsible for carry out your wishes.

3. Select and name your beneficiaries.

- Many people decide to include their favorite charity as one of their beneficiaries. Naming SafeHouse Denver – or any other nonprofit – in your will is a powerful extension of your values, a tremendous legacy and a lasting investment in the support of survivors in the future.

4. Identify who will get which assets; these can be tangible items like property and family heirlooms, or financial assets like retirement funds and savings accounts.

5. Consider attaching a letter to your will – perhaps some decisions need explanation or you can use it as a personal way to say goodbye.

6. Sign your will and have a witness sign the will; be sure to evaluate your state's regulations on who can/can't be a witness, how many witnesses are needed and any standards around having it notarized.

7. Store the will in a safe place, but make sure that a trusted person knows where it is.

8. Share your intentions and wishes as appropriate; it can often be a good idea to let the executor know that he/she has been named as such, and sharing your intention with a charity allows them to thank you for your commitment now, before the will comes to fruition.

9. Review and update regularly as life circumstances change; best practice says to review your will at least every 5 years.

Although it can be difficult to think about death and leaving our loved ones, creating or updating a will is truly an act of love. By sharing your directives, you ensure that difficult decisions are already made and that your final wishes are adhered to.

I Want To Leave A Bequest -- Now What?

Like many things, bequest giving can be simplified by who, what and where.

WHO

Who will be writing the will? Do you want to engage with a professional or go the DIY route? Like so much of estate planning, the right answer will be dependent on your unique situation. More complex estates may be better off with professional, individualized assistance; simpler plans could benefit from the ease of a DIY website or form.

- FreeWill.com is a reputable source if you choose the DIY path. Their services are free to you (the user) and they often partner with nonprofits.

WHAT

What will you be leaving in your bequest? This answer is completely up to you! Some common ways to include charity in your bequest include:

- Specific Bequest - Identify a specific amount the charity will receive:

- I leave $1,000 to SafeHouse Denver.

- Residual Bequest - Charity will share in a percent of your Estate remaining after Specific Bequests and costs of administration of the Estate are paid:

- I leave 15% of my Residual Estate to SafeHouse Denver.

- Remote Contingent Bequest - Charity will only receive your Estate if no other named beneficiaries are alive:

- If all named beneficiaries are no longer living, I leave the proceeds of my Estate to SafeHouse Denver.

WHERE

While we certainly hope that supporting survivors at SafeHouse Denver is among your favorite charities, the decision of where to leave your charitable bequest is entirely up to you. Do you leave a portion to your alma mater? Are you passionate about ensuring food security in your neighborhood? This is a great place to involve other family members and discuss what is important to you!

Surely many other factors will go into your own estate planning, but these three questions should help get you started.

Save Yourself Money -- Donate Using Your IRA

You've contributed to your IRA, saved money throughout your career, and now you're comfortably retired. For many individuals in this situation, it can be frustrating to be required to take funds from your IRA, especially if that income isn't needed right now.

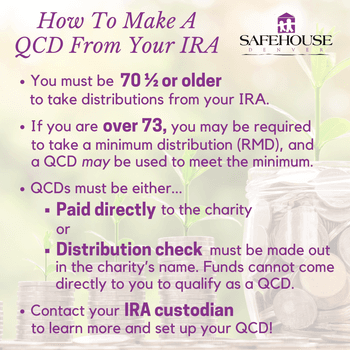

Thanks to Qualified Charitable Distributions (QCDs), you can donate some or all of your RMD to a qualified nonprofit, like SafeHouse Denver. By donating your RMD, you avoid the income tax and you are able to support survivors of domestic violence here in our community.

Many donors find that by utilizing a QCD option, they are able to make an even larger gift to charity. In 2021, Em, a longtime supporter, was featured on our blog. When Em began donating her RMD to SafeHouse, she said, "I was able to increase my annual gift significantly – and it didn't impact my taxable income at all! That let me have a greater impact now... when I can see it. And the remainder of my IRA will support survivors in the future!"

This is an easy, but often underutilized, planned giving strategy! If you're curious to learn more, there are great articles from Charles Schwab, Vanguard, Fidelity and others.

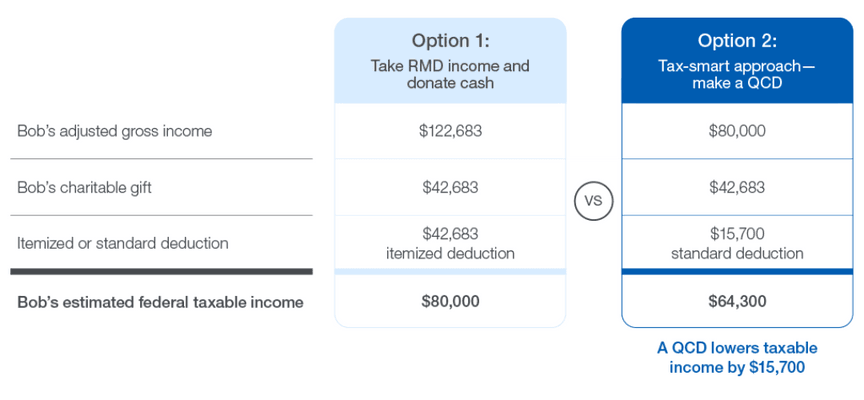

Here's a helpful example from Schwab Charitable:

Bob is 75 years old and has a required minimum distribution (RMD) of $42,683. His ordinary income is $80,000, and he doesn't really need the funds from the RMD this year. He's a passionate supporter of survivors of domestic violence, so he wants to donate his entire RMD to SafeHouse Denver. Let's see what his taxable income is if he takes the RMD income and then donates it to SafeHouse, versus if he uses a QCD:

It looks like Bob is better off sending his RMD right to SafeHouse Denver via a QCD!

Of course, Bob's example and every other individual's tax situation is unique. We always recommend consulting your tax professional on your personal situation.

At the end of the day, Bob's donation – and yours – will have a tremendous impact on survivors!

Why Give Stock?

If you have appreciated stock (meaning it is worth more today than it was worth when you purchased it), selling that asset will result in capital gains tax.

However, if you donate the stock to a charity, like SafeHouse Denver, no capital gains tax is assessed. Even further, you receive a tax deduction for the amount of stock you give!

So not only have you avoided capital gains tax, you're now eligible for a tax deduction – and you've supported your favorite cause. That’s a win-win-win!

Here's an example:

Leo feels compelled to give $1,000 to SafeHouse Denver after reading a survivor story. Leo is on a fixed income, so he doesn’t want to dip into his savings account. However, some time ago, he purchased $100 worth of Apple shares and it is now worth $1,000.

If Leo sells that stock, he'll be paying tax on the $900 of capital gains. Depending on Leo's tax bracket, that tax could be as high as 20% or $180. Now his gift to SafeHouse Denver is $820 – less than he wanted to give, unless he dips into savings for the rest.

However, if Leo gifts that stock to SafeHouse Denver, he will avoid the capital gains and can give the full $1,000 to support survivors. Better yet, Leo will receive a tax deduction for the full $1,000 gift, which could result in further tax avoidance at the end of the year.

Leo's choice to give $1,000 in stock is beneficial for him and for survivors. The $180 that is no longer going to Uncle Sam is enough funding to provide an additional 2 nights of safe shelter!

Quick Tips

Dylan Metzner – an Estate Planning Attorney and SafeHouse Denver Board Member – shares some quick, useful tips. Should you ever have interest in exploring any aspect of planned giving, please feel free to email Dylan.

Planned giving does not necessarily only refer to wills or bequests. All it means is that you've planned ahead – using the "Four Ws" – to make the most impact with your gift!

If you are considering making a Qualified Charitable Distribution (QCD) from your IRA, remember these tips.

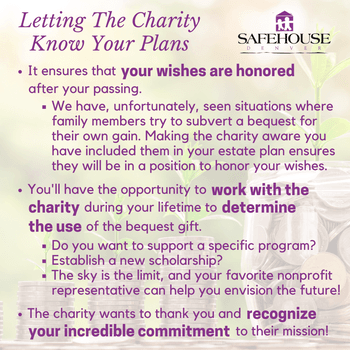

If you're comfortable, it is important to let the charity know that they've been included in your estate plans. There are several reasons why.

Do We Owe You A Thank You?

If you’ve already designated SafeHouse Denver in your estate plans, please let us know by emailing Michelle Wiley, Interim Chief Executive Officer, or calling her at 303-302-6120 or download and fill out this form.

By sharing your plans with us, we are able to properly thank you and recognize your incredible commitment to supporting survivors well into the future. Furthermore, we’d be happy to recognize you as a member of the Legacy of Hope Society. Members of the Society receive special invitations to events and are listed in our annual report. This special recognition acknowledges the long-term impact of your support and can encourage others to do the same.

Sample Language For Your Will

I hereby give [percentage, residuary share or specific amount or asset] to SafeHouse Denver, Inc. at 1649 Downing Street, Denver, CO 80218.

Legal Name & Address

SafeHouse Denver

1649 N. Downing St. Denver, CO 80218

Federal Tax ID Number

84-0745911

For more information about planned giving opportunities at SafeHouse Denver, contact Michelle Wiley, our Interim Chief Executive Officer, via email or call her at 303-302-6120.

"Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has." - Margaret Mead